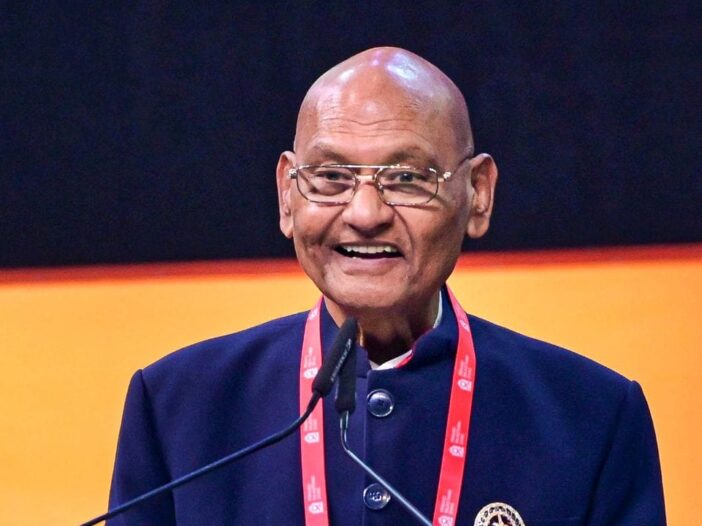

Anil Aggarwal, Chairman of Vedanta Limited, which is active from mining to metals, said on Wednesday that the target has been set to complete the division of various businesses by March 2026, after which five independent, listed and special sector based companies will come into existence. Aggarwal said the business separation will provide opportunities for each of Vedanta’s businesses to grow and each newly formed company will have the potential to be at par with its parent company. NCLT on Tuesday approved Vedanta’s business split plan. Under this plan, the base metals business will remain with Vedanta Limited while Vedanta Aluminium, Talwandi Sabo Power, Vedanta Steel and Iron and Malco Energy will be the other four independent companies.

Target set till March

Aggarwal said that Vedanta is like a huge banyan tree. There is immense potential in every business and every business itself can become a banyan tree. My vision is that every company should grow revenue at par with Vedanta. In fact, we are creating five more Vedantas, which will benefit the shareholders. He said that the process of business division is likely to be completed in the next three-four months. For this, the target has been set till March 2026. When asked about the reason behind the business split, Aggarwal said that most of the large resource companies globally operate in specialized businesses, and this restructuring is in line with this model.

All companies will have separate accounts

Under the business split, each shareholder of Vedanta will get one share of each new company for each share currently held. Each new company will have an independent board of directors and professional management. The promoters’ stake in these will be around 50 percent but they will not be involved in the daily operations. The Vedanta chairman said the company’s total debt is about Rs 48,000 crore, which will be distributed according to the cash flow of each new company after the business split. Referring to the plans of various businesses, Agarwal said that copper and silver production will be increased, aluminum capacity will be doubled and the target is to increase oil and gas production to 10 lakh barrels per day in the next four-five years.

Dividend and Capex Policy

Additionally, the steel and iron ore business will focus on green steel production and the power business will expand to 20,000 MW capacity. On capex and dividend policy, Aggarwal said that aggressive capex will continue even after business split and regular dividend will also continue. He said that business division will not only give each business an independent identity, but will also give a new direction to investment, production and innovation in Indian industry.

Leave a Reply