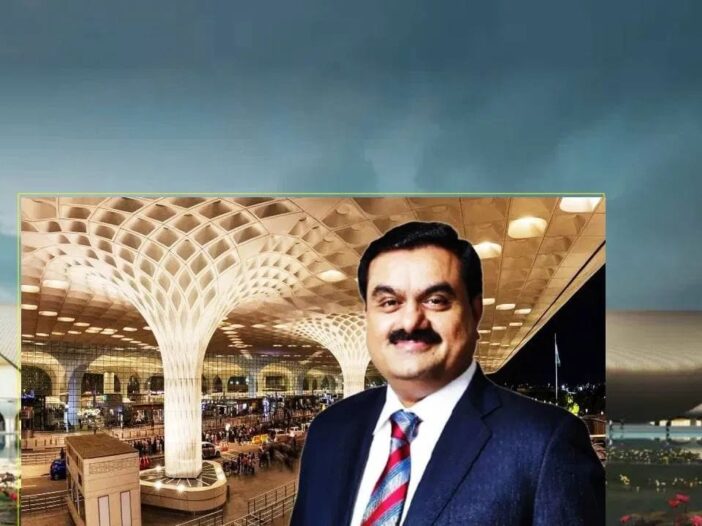

Gautam Adani’s group is going to invest 11 billion dollars i.e. about Rs 1 lakh crore by 2030 to expand its airport business. This investment will be made for bidding for new airport terminals, infrastructure upgrades at existing airports and expansion in new areas like aircraft maintenance. Adani Airport Holdings Limited Director Jeet Adani gave this information in an interview.

Preparation for IPO, plan to add new partner

Jeet Adani told that the company is planning to bring IPO of airport business by March 2028. For this, the airport unit can be separated from the main company Adani Enterprises. He said that he feels the demerger will provide better value for shareholders. Along with this, the company is considering involving a strategic investor before listing. However, formal talks have not started with anyone yet.

7 airports in operation, eye on 11 more

Adani Airport Company is currently running 7 big airports including Mumbai, Ahmedabad. Now it is preparing to bid for privatization of 11 new airport terminals. Terminals like Varanasi, Bhubaneswar and Amritsar can be included in this. The government is combining loss-making airports with profitable airports and giving them to private companies so that investment can be attracted.

Navi Mumbai airport will be a showpiece project

- Adani’s biggest focus is Navi Mumbai International Airport, which will open on December 25.

- Investment of Rs 20,000 crore in the first phase

- Capacity: 2 crore passengers annually

Investment of Rs 30,000 crore in the second phase

By 2030, monorail and Aero City with 20 hotels will also be developed. Passengers will be able to track baggage in real time and will have food options ranging from Vada Pav to Michelin-star dishes.

Attempt to restore trust after Hindenburg

This investment has come for Adani Group at a time when it is trying to improve its image by reducing debt and adding new investors. In 2023, the Hindenburg Report led to a huge decline in the market value of the company. Recently, the company has also completely denied the allegations made by America’s DOJ.

Leave a Reply